[Report] Mobile Megatrends 2012:

[Welcome to the new edition of our annual Mobile Megatrends report series. Megatrends 2012 analyses and interprets the nine most important trends of 2012, explaining how the software world is impacting the mobile business.]

The new Mobile Megatrends report

Mobile Megatrends 2012 is a 96-page research report – available for free

download from our website or

SlideShare – dissecting nine key themes:

-

Handset DELL-ification and the emerging pyramid of handset OEM

-

Web as the new walled garden and why the web is going back to the AOL days.

- Cross-platform tools as the next challenge to the Apple/Google duopoly

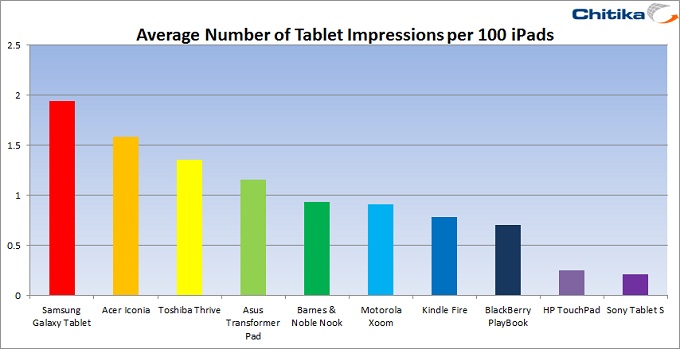

- The Kindelization of tablets – how Kindle is setting the rules of the tablet market

- Ecosystems battle across 4 screens and how experience roaming drives user lock-in, cross-sales and engagement

- Accessories as the next frontier for platform differentiation

- Tools for gold seekers and how the developer gold-rush has led to a gold rush for developer tools

- Reinventing the telco and how unbundling the telco is needed to compete in the software era

- The future of voice, from telephony to diversity of use cases

We’ll dig into two of these trends in this article – Handset DELL-ificationn and Cross-platform tools. To read the full analysis of all the trends, download the full

report – feedback welcome.

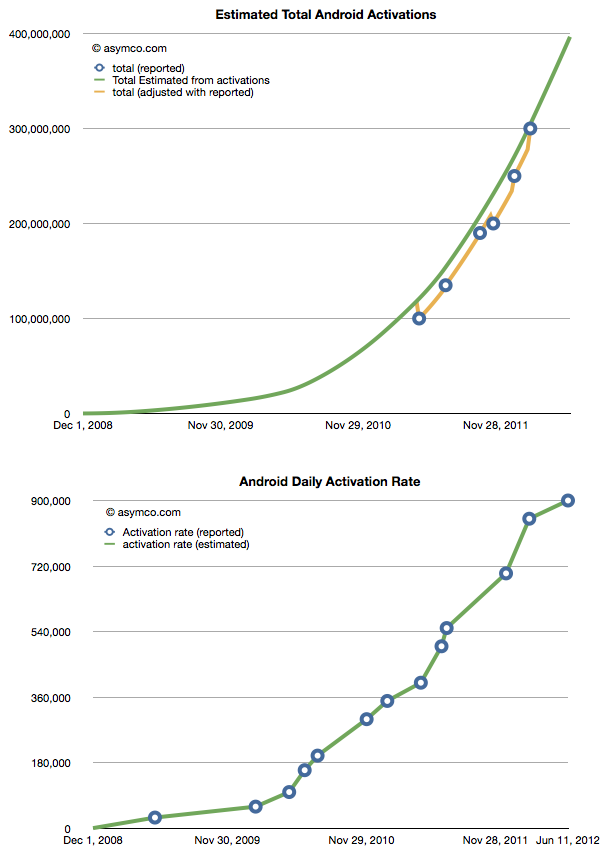

The DELL-ification of the handset market

In late 2010, it was

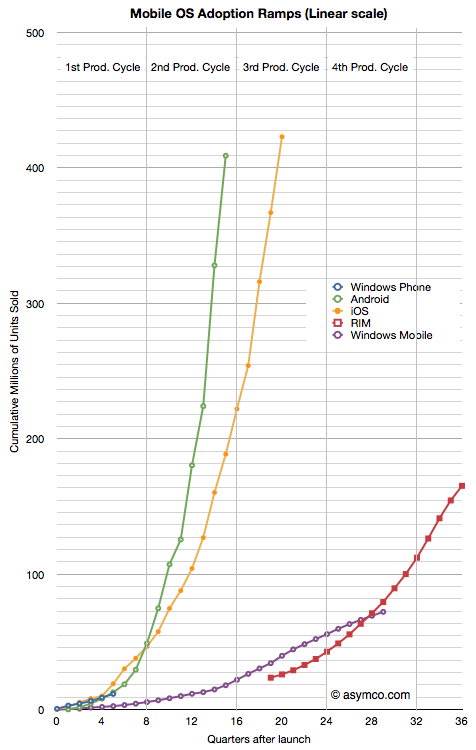

reported that Symbian had been toppled from the smartphone throne by Android. Back then, the difference in market share between Symbian and Android was just 2%. During 2011, the gap grew much larger, with Android claiming more than half of the shipments in the smartphone market, and Symbian dropping to single digits of market share. Android’s dominance in 2011 can be summarized in just one phrase: One in two smartphones shipped in 2011 was an Android handset.

The driver to Android’s success was the eagerness of many handset manufacturers to build cheap smartphones that can compete against the iPhone. Google, too, used Android to commoditize the smartphone market, indirectly reducing handset price points well below $100 and causing a loss of OEM differentiation, thus homogenizing smartphones into a single form factor.

While many handset rode the Android train into the smartphone market, it’s actually very few that are making real profits. Aside from Apple, Samsung is the only company of the Android court that’s achieving profitability. Together,

Apple and Samsung accounted for 99% of all handset profits in Q1 2012. That means that 10s of Android handset makers will have to fight over the crumbs of the smartphone pie, i.e. the remaining 1% of the market profits.

The success of Apple and Samsung rests on their ability to add value across the entire value chain, from silicon to the cloud. Apple owns the iOS platform, hardware IP, handset design, content delivery and services, all the way to retail, combining these into a unique product experience.

Samsung also derives its competitive advantage from exerting control over the entire value chain, producing the components with the highest cost, notably screens and application chipsets. This allows the company to capture profits across the value chain, while its competitors can only capture the value of assembly. Ownership of the key components within the value chain allows Samsung to reap not only profit benefits, but also availability and time-to-market benefits. Samsung also leads Android makers by being the first to market with new Android releases and next-gen screens, which allows it to capture even more profits arising from early adopter sales.

Does all this mean that the smartphone market is entirely dominated by Samsung and Apple? While this might be true for the time being, there’s still room for new types of players, like Amazon, who could enter the smartphone market with a unique business model of subsidizing (self-branded) phones to drive a content and retailing ecosystem. Nokia continues to innovate in low-end handsets, notably with the release of the 110 phone running on S40 platform, and featuring a 1.8’’ screen at only 38 EUR before taxes and subsidy. To read more on the opportunities of the smartphone market, download the

full report.

Cross-Platform Tools and the challenge to the Apple/Google duopoly

In order to maximize their reach, developers need to have apps running across multiple platforms. The challenge with that is that developers have to learn a variety of different programming languages, vastly different to each other, as well as use various app stores. The situation is especially difficult for developers who are just entering mobile – and there are millions of those!

Cross-platform tools are a solution to increasing reach without accruing costs, by simplifying the porting of an app across different platforms. There’s a plethora of different tools available (see our comprehensive Cross-Platform Tools 2012

report for the full list), which cover diverse technologies and solutions, from source code translators to hybrid web tools. Impeded by teething issues, the CPT market has not come into full swing yet, but it’s quickly gaining acceptance with leading tools like PhoneGap and Sencha that have made it into the mainstream.

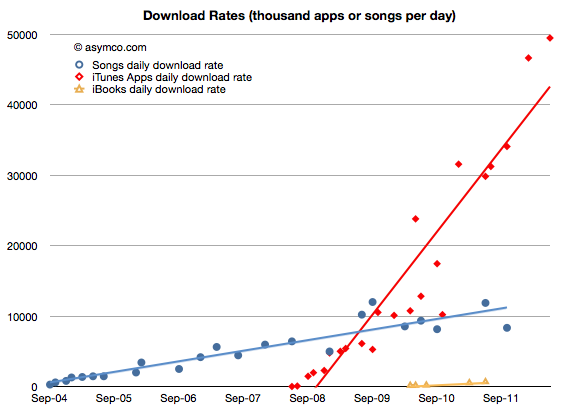

What CPTs bring to the table is the democratization of development, by extending the reach of masses of web developers beyond the browser. Despite performance disadvantages and fragmentation across different browser versions, HTML5 has emerged as the most widely supported authoring technology for cross-platform apps. Cross-platform tools are taking HTML further than web browsers can, by allowing web developers to create native smartphone apps, using for example PhoneGap. CPTs are accomplishing this by unifying the authoring side- rather than the runtime side – of the app across platforms.

In addition, cross-platform tools are threatening the Apple/Google duopoly. 2012 marks an inflexion point in the war of mobile ecosystems where the network effects built by Apple and Google are being challenged by an unsuspected new entrant – CPTs make it easier, for example, for an iPhone developer to reach Android and Windows Phone 7 users. CPTs dilute network effects by allowing other ecosystems to compete not just in terms of the number of apps listed, but also the availability of top apps, the time-to- market (an app rarely appears at the same time across all platform app stores) and the overall app quality.

We expect web developers to be at least ten times as many as native mobile developers, which means that the still-nascent CPT market will quickly grow in the near future. Although not necessarily a replacement for native development, cross-platform tools will become more prominent, easing the way for 100s of thousands of developers who are just entering the mobile market.

Read more on the growth of the CPT space and the top vendors in the

full report.

The Megatrends report series

Now in its 5th edition, our annual Mobile Megatrends report identifies the major trends in mobile – from the accessories market to the Kindel-ization of tablets and the battle of ecosystems across 4 screens.

The full report is available as a free

download. You can also view the whole report on SlideShare (see embedded window at top of article)

If you’re interested in a 1-day on-site strategy workshop – with more in-depth insights into these trends, contact

matos@visionmobile.com

Feedback welcome, as always

- Matos

@

visionmobile

![Clash of Ecosystems: The life and death of mobile platforms [Infographic] Clash of Ecosystems: The life and death of mobile platforms](http://www.visionmobile.com/blog/wp-content/uploads/infographics/6/VMInfoCoE_500.png)